Nasdaq 100 Index: Hitting targets as AI FOMO rally keeps the party going! Index recently hit the 17176 targets! Next targets 18000/18233. Beware consolidation and P&F chart reversal risk to signal the end of the current rally! AI expectations keeping the party going and going!

Friday 23 February 2024

S&P500 Index AI driven rally hitting P&F targets @ 4902/5001 and close to 5101 with next target 5152. Beware consolidation/reversal risk close to targets. Party like its 1999!

S&P500 Index AI FOMO driven rally hitting P&F targets @ 4902/5001 and close to 5101 with next target 5152. Beware consolidation/reversal risk close to targets. Party like its 1999!

Thursday 22 February 2024

NVDA: Blast off after a great earnings result. NVDA getting closer to 785/793 upside P&F targets! 809/834 not far off! AI party party time!

NVDA: Blast off after a great earnings result. NVDA getting closer to 785/793 upside P&F targets! 809/834 not far off! AI party party time! Beware any consolidation and P&F chart reversals to signal the end of the rally and a period of consolidation.

Bumper earnings report!

Thursday 15 February 2024

BTCUSD Bitcoin reached the 50000/50500 & 52000 P&F targets after a strong rebound from support at 38000. Next upside targets are 53500/56500!

BTCUSD Bitcoin reached the 50000/50500 & 52000 P&F targets after a strong rebound from support at 38000. Next upside targets are 53500/56500! Beware any P&F chart reversals to the downside to signal the end of the current rally and a consolidation at support zones before the setup for the next advance!

Looking intraday chart, there is a cluster of targets around the 54250/55250/55500 zones!

Could see a consolidation around these targets once met. Beware any major P&F chart reversals to the downside to signal the consolidation period. Trend line support zones possible rebound zones!

Wednesday 14 February 2024

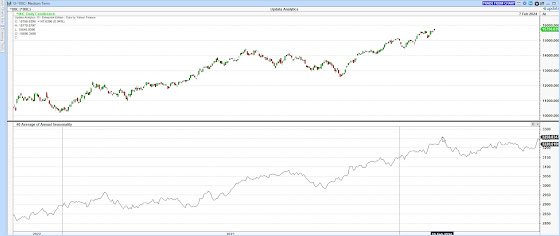

NDX100: Consolidating after hitting 18000 P&F target! This comes soon after hitting 16700/17000/17200 targets. Seasonal downside consolidation risk down to 17400/17200/17000!

NDX100: Consolidating after hitting 18000 P&F target! This comes soon after hitting 16700/17000/17200 targets. Seasonal downside consolidation risk down to 17400/17200/17000! Next upside targets after consolidation is 18100/18200/18300!

Beware Q1 seasonality!

NDX 100 Index still following seasonal patterns. It is doing what it does this time of the year! So far so good!

NDX 100 Index still following seasonal patterns. It is doing what it does this time of the year! So far so good! Here the 40 year and 20 year average annual seasonal patterns to compare to the current rally.

Tuesday 13 February 2024

Monday 12 February 2024

NVDA up 62% in 66 days since the Cloud Chart buy signal! NVDA very extended and in need of a consolidation.

NVDA up 62% in 66 days since the Cloud Chart buy signal! NVDA very extended and in need of a consolidation.

NVDA: AI party keeps going as NVDA hit the 725 target! Next target 745 and a tasty looking 750 to 775!

NVDA: AI party keeps going as NVDA hit the 725 target! Next target 745 and a tasty looking 750 to 775! Beware any P&F chart reversals and consolidations at and around targets to signal the end of this climatic rally!

Nasdaq 100 Index: Hitting targets as the AI rally keeps the party going! Index recently hit the 17000/17200 targets! Next targets 18000/18100/18200 and 18300!

Nasdaq 100 Index: Hitting targets as AI rally keeps the party going! Index recently hit the 17000/17200 targets! Next targets 18000/18100/18200 and 18300! Beware consolidation and P&F chart reversal risk to signal the end of the current rally! AI expectations keeping the party going and going!

Nasdaq Composite Index: Hitting targets as AI rally keeps the party going! Next targets 16000/16400! Beware consolidation and P&F chart reversal risk!

Nasdaq Composite Index: Hitting targets as AI rally keeps the party going! Index recently hit the 15100/15200 and 15500 targets! Next targets 16000/16400! Beware consolidation and P&F chart reversal risk to signal the end of the current rally!

Thursday 8 February 2024

Earnings Scorecard: For Q4 2023 (with 46% of S&P 500 companies reporting actual results), 72% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue surprise.

Key Metrics

Earnings Scorecard: For Q4 2023 (with 46% of S&P 500 companies reporting actual results), 72% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue surprise.

Earnings Growth: For Q4 2023, the blended (year-over-year) earnings growth rate for the S&P 500 is 1.6%. If 1.6% is the actual growth rate for the quarter, it will mark the second-straight quarter that the index has reported earnings growth.

Earnings Revisions: On December 31, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q4 2023 was 1.5%. Seven sectors are reporting higher earnings today compared to December 31 due to positive EPS surprises.

Earnings Guidance: For Q1 2024, 31 S&P 500 companies have issued negative EPS guidance and 17 S&P 500 companies have issued positive EPS guidance.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 20.0. This P/E ratio is above the 5-year average (18.9) and above the 10-year average (17.6).

Check out the report here by FACTSET:

Nasdaq Composite (IXIC) performing well in line with seasonal trends this time of year. IXIC still doing what it does this time of year, but beware the seasonal weak period ahead!

Nasdaq Composite (IXIC) performing well in line with seasonal trends this time of year. IXIC still doing what it does this time of year, but beware the seasonal weak period ahead!

IXIC still following the 40 year average seasonal trends , with downside risk going deeper into February on a seasonal basis. Critical weeks ahead!

S&P500 still doing what it does this time of year, but beware the seasonal weak period ahead! Critical weeks ahead!

S&P500 still doing what it does this time of year, but beware the seasonal weak period ahead! Critical weeks ahead!

S&P500 still following the 40 year average seasonal trends , with downside risk going deeper into February on a seasonal basis.

Wednesday 7 February 2024

S&P500 Index getting closer to the 5000 P&F target. This comes soon after hitting the 4700/4750/4800/4850 & 4900 P&F targets! Targets after the 5000 level are 5050/5100! Ripe for consolidation!

S&P500 Index getting closer to the 5000 P&F target. This comes soon after hitting the 4700/4750/4800/4850 & 4900 P&F targets! Targets after the 5000 level are 5050/5100!

Beware a P&F chart reversal to signal the end of the current trend and the start of a consolidation. Downside consolidation risk are 4800, 4600 & 4550! But so far so good, the 5000 party is on its way! Party like its 1999 for the extended S&P500 Index!

NASDAQ100: NDX hit 17200 P&F chart target! Next targets 18000, 18100/18200 as the AI & conspicuous consumption bubble rally gains steam!

NASDAQ100: NDX hit 17200 P&F chart target! Next targets 18000, 18100/18200 as the AI & conspicuous consumption bubble rally gains steam! Beware Q1 seasonality and any P&F chart reversals to signal the end of the trend! NDX hit the 17200 soon after hitting the 17000, 16700 targets! Downside risk target is 16400 close to P&F trend line support zone!

META: King of the social sewage stocks, reached the 468 target. Now consolidating recent gains with downside support targets: 445/438.

META: King of the social sewage stocks, reached the 468 target as well as a FIB target of 473! Now consolidating recent gains after the P&F sell signal at 480, with downside support targets: 445/438. Looking out for the next P&F chart buy signal!

Friday 2 February 2024

Meta: Up 59% since Cloud Chart buy signal! What a rally! Very extended now from the Cloud! King of the social sewer stocks doing great!

Meta: Up 59% since Cloud Chart buy signal! What a rally! Very extended now from the Cloud! King of the social sewer stocks doing great! Need a consolidation now to develop a new support zone!

Dividend and buyback made for a few new surprises in Meta! 384.33 new support zone in this rally!