NDX 100 & NDX 100 Equal Weighted Chart Review:

NDX 100:

Great rebound from old high and 34 EMA, broke past October high, now need to see a follow-through of this move. October high expected to be tested for support!

NDXE: Nasdaq 100 Equal Weighted Index:

Rebounded from old highs and key support zones. So far so good. Next key resistance zone is the October high of 3434.

RISK: The NDX has made a new high and broken out, as where the NDXE did not. It only rebounded from key support zone. Need to see this new rally to continue from this support zone for the NDXE!

Monday 30 October 2017

Nasdaq Comp Index:Rebounded from support, need to see continuation of rally!

Nasdaq Comp Index:Rebounded from support, now need to see continuation of rally!

Rebounded from 6517 support zone at the 34 period moving average. Fantastic rebound, broke past old high resistance zones, now we need to see a follow-through of this breakout!

Rebounded from 6517 support zone at the 34 period moving average. Fantastic rebound, broke past old high resistance zones, now we need to see a follow-through of this breakout!

EURUSD: Downside risk towards 1.1516!

EURUSD: Locked in a downtrend with old cloud chart support level of 1.1516 as the next key support zone.

Price action is below the cloud, and front cloud indicate long term down trend remain in place.

Price action is below the cloud, and front cloud indicate long term down trend remain in place.

GBPUSD: On its way to test trend support at 1.3055

GBPUSD on its way to test old highs and trend line support around the 1.3055 zone! Sterling is down more than 300 points since the sell signal. Looking for support and signal change for a potential rebound at support zone!

Thursday 26 October 2017

Nasdaq Comp Index: Consolidation risk down towards old high support zones!

Nasdaq Comp Index: Consolidation risk down towards old high support zones!

Key levels to watch in current consolidation are 6474/6459 old high support zones.

Key levels to watch in current consolidation are 6474/6459 old high support zones.

Tuesday 24 October 2017

FTSE100: Rally taking a break after running into major resistance zone!

FTSE100: Rally taking a break after running into major resistance zone!

Expect a consolidation back down towards key moving averages. Old high resistance levels remained in place, and FTSE 100 failed to break past these levels. Note MACD sell signal, expect a consolidation lower.

www.metastock.com/alphaharvest

Expect a consolidation back down towards key moving averages. Old high resistance levels remained in place, and FTSE 100 failed to break past these levels. Note MACD sell signal, expect a consolidation lower.

www.metastock.com/alphaharvest

S&P500 Index: Getting ready for profit taking!

S&P500 Index: Getting ready for profit taking!

Expect a period of consolidation and profit taking at these elevated levels. Consolidation risk back down to moving averages as per chart. Note MACD signal on chart.

www.metastock.com/alphaharvest

Expect a period of consolidation and profit taking at these elevated levels. Consolidation risk back down to moving averages as per chart. Note MACD signal on chart.

www.metastock.com/alphaharvest

Monday 23 October 2017

DowJones 30 Index hitting P&F chart targets!

DowJones 30 Index hitting P&F chart targets!

Recently the Dow Jones 30 Index hit 23250 point and figure chart target. Next target is 23550, but beware consolidation/reversal risks at these levels.

Recently the Dow Jones 30 Index hit 23250 point and figure chart target. Next target is 23550, but beware consolidation/reversal risks at these levels.

Friday 20 October 2017

FTSE100 Having a hard time to breakout past key resistance zones!

FTSE100 Having a hard time to breakout past key resistance zones of 7550/7563. Consolidation back down to moving average support levels remain high.

www.metastock.com/alphaharvest

www.metastock.com/alphaharvest

STOXX600 consolidation well underway now!

STOXX600 consolidation well underway now since sell signal. Expect price convergence with moving averages as key support zone.

http://www.metastock.com/alphaharvest

http://www.metastock.com/alphaharvest

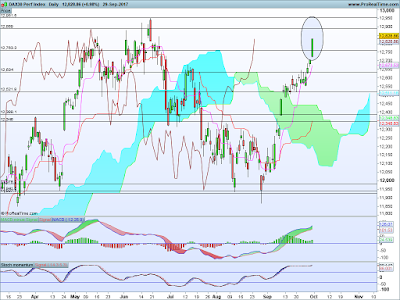

Xetra Dax Index moving into profit taking zone!

Xetra Dax Index moving into profit taking zone!

Taking some profit here since the MACD sell signal, expect a consolidation to take place and price converging with moving averages.

www.metastock.com/alphaharvest

Taking some profit here since the MACD sell signal, expect a consolidation to take place and price converging with moving averages.

www.metastock.com/alphaharvest

Monday 16 October 2017

Dow Jones 30 Index: Steady grind higher, with and eye on profit taking at these levels!

Dow Jones 30 Index: Steady grind higher, with and eye on profit taking at these levels!

So far so good, we had a great rally since the buy signal. Overall outlook remains bullish, but do expect some form of consolidation of recent rally as market digests its gains. Key support levels to watch are: 22650/22414. Its into profit taking zone now, so watching for any topping out action around 23000 zone.

www.metastock.com/alphaharvest

So far so good, we had a great rally since the buy signal. Overall outlook remains bullish, but do expect some form of consolidation of recent rally as market digests its gains. Key support levels to watch are: 22650/22414. Its into profit taking zone now, so watching for any topping out action around 23000 zone.

www.metastock.com/alphaharvest

S&P500 Slow grind higher with an eye on profit taking!

S&P500 Slow grind higher with an eye on profit taking!

Slow grind higher since buy signal. Overall outlook remain bullish. Key support levels to watch are 2553/2540 zones. Do expect some form of consolidation towards key moving averages as per chart. Keeping an eye on that MACD signal set to come!

www.metastock.com/alphaharvest

Slow grind higher since buy signal. Overall outlook remain bullish. Key support levels to watch are 2553/2540 zones. Do expect some form of consolidation towards key moving averages as per chart. Keeping an eye on that MACD signal set to come!

www.metastock.com/alphaharvest

FTSE100: Fighting resistance at old high resistance zones!

FTSE100: Fighting resistance at old high resistance zones!

Fighting hard to get past old high resistance zones between 7551, and next key level of 7598. Consolidation risk remain high at these key resistance levels!

www.metastock.com/alphaharvest

Fighting hard to get past old high resistance zones between 7551, and next key level of 7598. Consolidation risk remain high at these key resistance levels!

www.metastock.com/alphaharvest

German DAX testing old high resistance for new support zone!

German DAX testing old high resistance for new support zone!

Consolidation risk towards old high level of 12956, with another key support zone at 12831.

Need to see a stronger follow-through here after recent breakouts.

www.metastock.com/alphaharvest

Consolidation risk towards old high level of 12956, with another key support zone at 12831.

Need to see a stronger follow-through here after recent breakouts.

www.metastock.com/alphaharvest

Friday 13 October 2017

BTC= Bitcoin USD up $2480 since cloud chart support rebound buy signal!

BTC= Bitcoin USD up $2480 (+78%) since cloud chart support rebound buy signal!

Bitcoin had a strong rally so far since the rebound buy signal from the cloud chart support zone at 3155 at bottom end of the cloud. The secondary signal came at 3929 MACD buy still below top end of the cloud. It managed to break past old high resistance level of 4979, and this is the new support zone for this rally. Top end of the cloud at 4388 at front part of the cloud is also a secondary support zone in the current uptrend.

So far so good, but consolidation risk remain!

www.metastock.com/alphaharvest

Bitcoin had a strong rally so far since the rebound buy signal from the cloud chart support zone at 3155 at bottom end of the cloud. The secondary signal came at 3929 MACD buy still below top end of the cloud. It managed to break past old high resistance level of 4979, and this is the new support zone for this rally. Top end of the cloud at 4388 at front part of the cloud is also a secondary support zone in the current uptrend.

So far so good, but consolidation risk remain!

www.metastock.com/alphaharvest

Thursday 12 October 2017

GBP ran into old high resistance zones, outlook remain bearish.

GBP ran into old high resistance zones, outlook remain bearish.

GBP ran into old high resistance levels around 1.3262, with next support level to be tested at 1.3055. Overall outlook remain bearish from a MACD trading perspective.

www.metastock.com/alphaharvest

GBP ran into old high resistance levels around 1.3262, with next support level to be tested at 1.3055. Overall outlook remain bearish from a MACD trading perspective.

www.metastock.com/alphaharvest

CADUSD: Close to key resistance and profit taking targets.

CADUSD: Close to key resistance and profit taking targets.

Had a good little rally post MACD buy signal, now close to key resistance levels of 1.2468!

www.metastock.com/alphaharvest

Had a good little rally post MACD buy signal, now close to key resistance levels of 1.2468!

www.metastock.com/alphaharvest

NZD fighting for support at old high levels!

NZD fighting for support at old high levels!

Rebounded from 0.7051old high support levels, but already close to key old low resistance zones of 0.7109 and next level 0.7189 zones.

Overall outlook remain bearish, and not yet seen MACD signal change.

www.metastock.com/alphaharvest

Rebounded from 0.7051old high support levels, but already close to key old low resistance zones of 0.7109 and next level 0.7189 zones.

Overall outlook remain bearish, and not yet seen MACD signal change.

www.metastock.com/alphaharvest

Monday 9 October 2017

GBPUSD: Fighting hard for support at key support level: 1.3055!

GBPUSD: Fighting hard for support at key support level: 1.3055!

Overall outlook bearish, with short term rebounds from key support levels.

Currently fighting hard for support at 1.3055 zone. Resistance zones now remain in place at 1.3262.

Old highs being tested for new support.

Overall outlook bearish, with short term rebounds from key support levels.

Currently fighting hard for support at 1.3055 zone. Resistance zones now remain in place at 1.3262.

Old highs being tested for new support.

EURUSD: Outlook remain bearish, fighting for support at 1.1743!

EURUSD: Outlook remain bearish, fighting for support at 1.1743!

Overall outlook remain bearish, with old support low of 1.1743 being tested. the 1.18 zone is a new resistance zone.

Overall outlook remain bearish, with old support low of 1.1743 being tested. the 1.18 zone is a new resistance zone.

SPY (S&P500 ETF) and S&P500 sector ETF Cloud Chart market review October 2017.

SPY (S&P500 ETF) and S&P500 sector ETF Cloud Chart market review October 2017.

I review the S&P 500 SPY ETF as well as the sector ETF's from a cloud chart signal perspective. Key support and resistance levels are identified.

Tickers covered: SPY, XLB, XLE, XLF, XLI, XLK, XLP, XLRE, XLU, XLV, XLY.

Happy trading,

Regards Richard

Thursday 5 October 2017

G10FX Cloud Chart Trading: October G10FX review!

G10FX FX cloud chart currency trade review:

FX pairs covered in the October cloud chart FX market review:

AUD/USD EUR/USD GBP/USD NZD/USD USD/CAD USD/CHF USD/DKK USD/JPY USD/NOK USD/SEK

Key support and resistance levels are discussed from a cloud chart trading perspective.

FX pairs covered in the October cloud chart FX market review:

AUD/USD EUR/USD GBP/USD NZD/USD USD/CAD USD/CHF USD/DKK USD/JPY USD/NOK USD/SEK

Key support and resistance levels are discussed from a cloud chart trading perspective.

Wednesday 4 October 2017

GBPUSD: The heat is on, fighting for support at top end of weekly cloud!

GBPUSD: The heat is on, fighting for support at top end of weekly cloud!

At a critical zone, top end cloud chart support zone! GBP fighting hard for support at this level 1.3250!! Short term rebound possible around this zone if support holds.

Looking at daily chart, key support zone to watch here is cloud chart level of 1.3204! Could see a short term rebound at that level if support holds.

At a critical zone, top end cloud chart support zone! GBP fighting hard for support at this level 1.3250!! Short term rebound possible around this zone if support holds.

Looking at daily chart, key support zone to watch here is cloud chart level of 1.3204! Could see a short term rebound at that level if support holds.

EUR/USD: Fighting hard for support at top end cloud chart support levels.

EUR/USD: Fighting hard for support at top end cloud chart support levels. Bottom of cloud is next key support zone if this support test at top end of the cloud fails.

Fighting hard for support at 1.1712 support zone! Potential for a short-term relief rally from here.

Looking at 4 hour chart, the bottom end of the cloud remain a key resistance zone.

Weekly chart indicate the front cloud level of 1.16 is a key support zone in this correction.

The Euro pulled back after running into significant resistance around the 1.19 zones!

Fighting hard for support at 1.1712 support zone! Potential for a short-term relief rally from here.

Looking at 4 hour chart, the bottom end of the cloud remain a key resistance zone.

The Euro pulled back after running into significant resistance around the 1.19 zones!

Monday 2 October 2017

Silver USD : losing the fight for support at top end of the cloud

Silver Spot - Ounce Silver USD : losing the fight for support at top end of the cloud: 16.80.

Next key support level:16.48, with a major support zone at 16.05, bottom end of the cloud chart support zone!

Next key support level:16.48, with a major support zone at 16.05, bottom end of the cloud chart support zone!

COMEX Futures - Gold Full1217 Future : fighting hard for support at top end cloud levels!

COMEX Futures - Gold Full1217 Future:

Fighting hard for support at top end of the cloud! Key support zone being tested here at top cloud level. Downside risk remain towards bottom end cloud chart support levels.

Top cloud support being tested: 1284.

Bottom cloud support zone:1258.

Gold is down $56 since sell signal. Looking for rebound at cloud support levels!

Fighting hard for support at top end of the cloud! Key support zone being tested here at top cloud level. Downside risk remain towards bottom end cloud chart support levels.

Top cloud support being tested: 1284.

Bottom cloud support zone:1258.

Gold is down $56 since sell signal. Looking for rebound at cloud support levels!

DJ30 Index- Need to break past 22414 old high resistance zone!

DJ30 Index- Need to break past 22414 old high resistance zone! Support zone is top end of front cloud: 22219!

S&P500 Index-Slow grind higher,old highs key support zones:2508/2495

S&P500 Index-Slow grind higher,old highs key support zones:2508/2495.Consolidation risk remain:top cloud support.

NASDAQ Composite Index -Broke past old high resistance: 6477.

NASDAQ Composite Index -Broke past old high resistance: 6477. Need to see a follow through of upside breakout!

FTSE100 Index -On its way to fight cloud chart resistance at 7428.

FTSE100 Index -On its way to fight cloud chart resistance at 7428. Top end of the cloud is a major resistance zone!

XETRA DAX 30: heading to next resistance zone: 12889

XETRA DAX 30: Broke past cloud resistance, heading to next resistance zone: 12889. Consolidation risk remain at these elevated levels.

Subscribe to:

Posts (Atom)