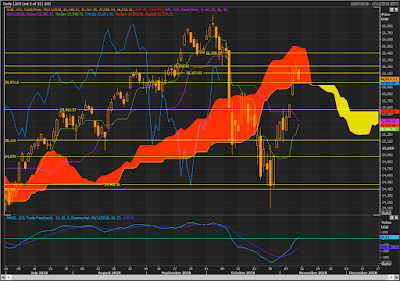

- Dax testing support at old cloud chart support level of 10370, but the price action is below the cloud and overall long-term bearish!

- Short-term swing trade possible back up to the bottom end cloud level or 11567/11280 resistance zones! (provided support holds at key levels)

Bottom end of the cloud on the daily chart of 11280 is a key resistance zone in the current down-trend.

- Swing trade opportunity here if support holds, back up to cloud resistance.

- Downside risk towards 10370/10059 remain in place.

- Dax is now down more than 2300 points since the initial sell signal on a cloud chart basis! A Tasty short as they say!