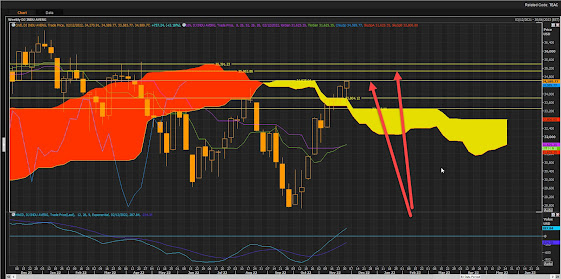

TSLA: "In Musk We Trust" Trade reached the next downside Cloud Chart (CC) targets of 127/109! TSLA down +65% since the most recent CC sell/short signal! This comes soon after hitting downside targets of 195/180/161 and 127!

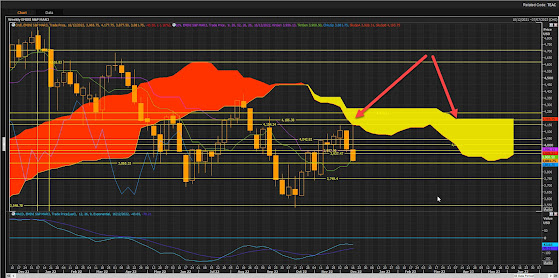

There is downside risk to the next Cloud Chart Targets (CC) of 90 & 66 if support does not come back into the stock at key CC support zones! Price action below the Cloud remains bearish long-term! Looking out for a CC rebound reversal at support zones to signal the end of the trend.

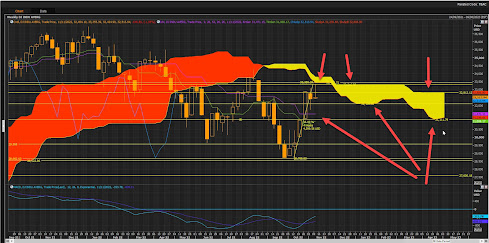

TSLA also hit the downside P&F chart targets of 177/156/153/147 and more recently the 117 target. Getting close to the next 108 target! Looking out for a P&F chart reversal to the upside to signal the end of the current trend!

On the monthly CC downside targets met were 213/156, with a cluster support zone at 95/93 & 89 old Cloud Chart support zones! Potential rebound zone!